💰 How do you develop confidence in your ability to impact GRR/NRR?

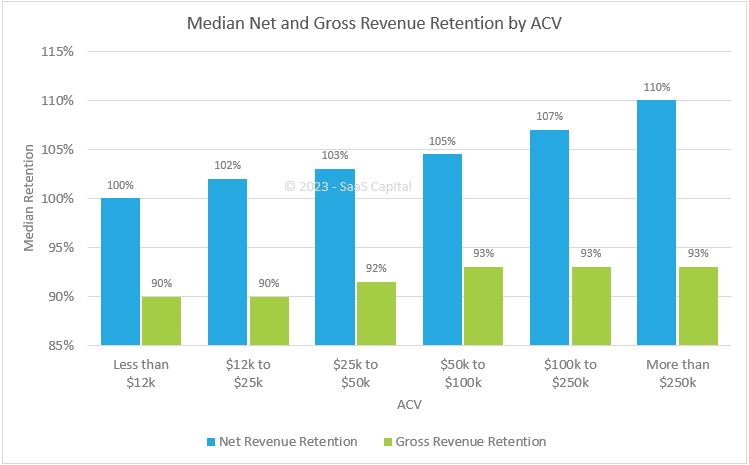

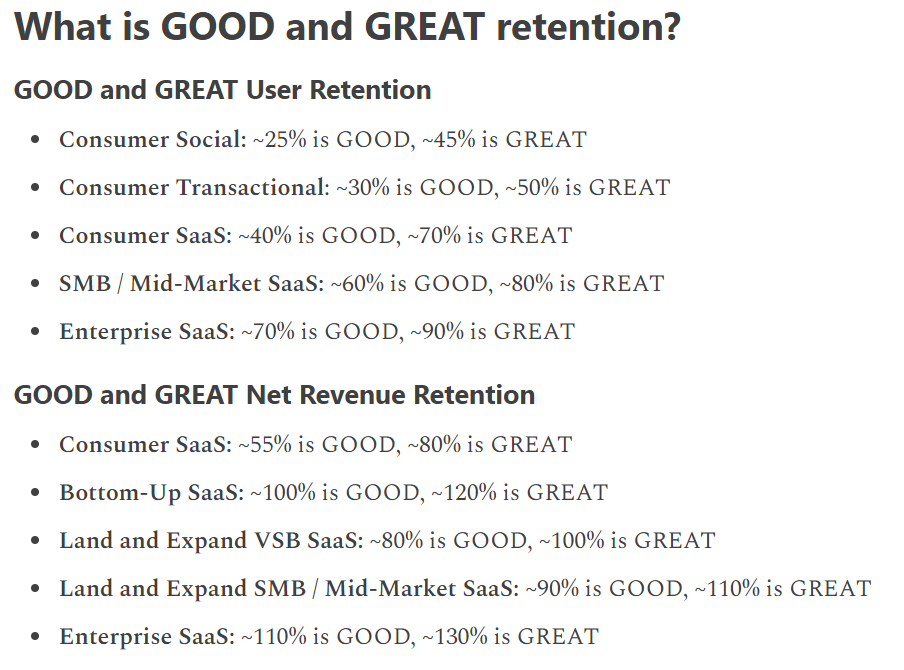

Post-sale teams are tasked with driving GRR and NRR - the key lagging metrics of a SaaS business. If the bucket is too leaky, there’s no way to get off the ground (GRR). And if you can’t consistently expand with customers, you won’t stay in orbit for very long (public company NRR median is ~115%, top quartile is 120%+).

🚦 What are your leading indicators?

What actually impacts these lagging metrics is a question that must be continuously assessed and answered.

Our leading indicators drive our Health Score. Specifically for measuring outcomes, we use the “DEAR” Framework. Each measure and threshold is based on correlating performance 6 months before the renewal with the renewal outcome:

At Gainsight, we’ve shifted to re-assessing health scoring to 2x per year vs. annual or more as market conditions change quickly.

📊 What did we learn this quarter about our leading indicators?

We reconfirmed the “recipe” continues to be two key pieces:

- Strategic Adoption: Driving the right kind of adoption - using the features that will achieve the customer's goal.

- Quantitative Verified Outcome - a statement of ROI by the decision maker - "Because of Gainsight, we have reduced time to resolve risk by 25% leading to a $

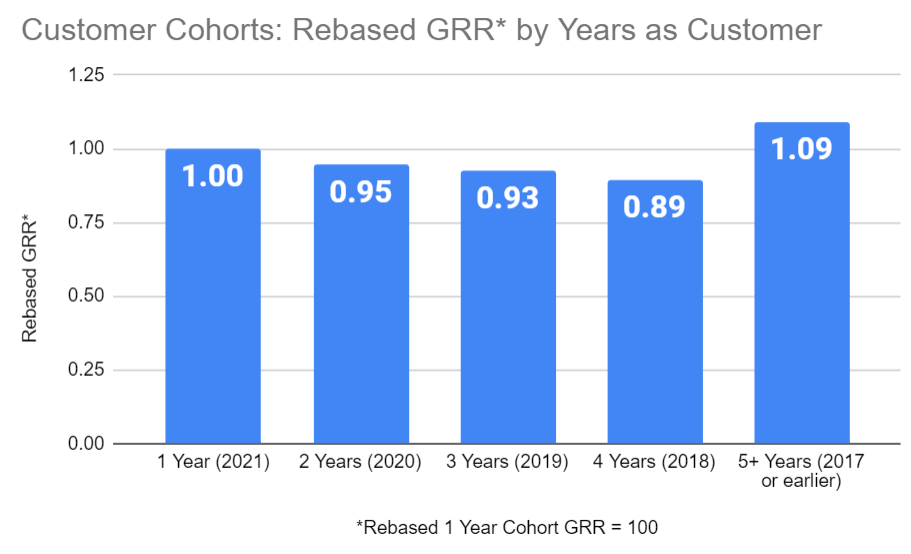

📈 Highest GRR Cohort: Customers with High Adoption and 1+ Verified Outcomes

📉 Lowest GRR Cohort: Low Adoption and No Verified Outcomes

💡 Interestingly, Low Adoption w/ VO has higher GRR than High Adoption w/o VO. Adoption is necessary but not sufficient.

Here's a high level summary of cohort performance!