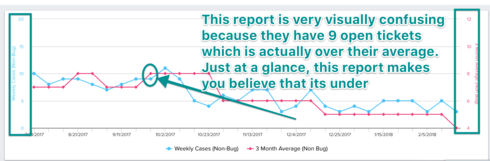

This report (see screenshot) is very confusing because the two axis don't match up. In scenarios where these values range drastically (i.e. one axis is values like 10 while the other has values in the thousands) I understand why it behaves this way, however when the data values are smilier the axis scaling should be the same. What I'd like to do with this report is to at a glance tell if a customer is over their 90 day rolling average. As you can see below its very misleading because one graph is scaled slightly different to the other even though the values only vary by just a few single numbers. This makes me think an account is under when in reality they are over what they should be.

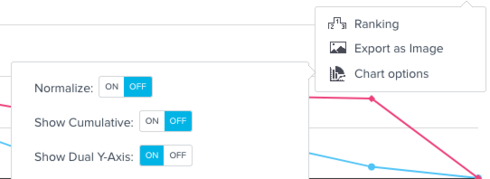

Update: you can turn off the "Dual Y Axis" in the Chart Options. This really solves the pain point here, because you can turn it on for large variances and off for reports like mine. Screenshot attached in how to turn this off.

Sign up

If you ever had a profile with us, there's no need to create another one.

Don't worry if your email address has since changed, or you can't remember your login, just let us know at community@gainsight.com and we'll help you get started from where you left.

Else, please continue with the registration below.

Welcome to the Gainsight Community

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.